This article was researched and written by Zac McClure, CEO, and Barrett Strickland, Head of Research at TokenTax, and originally published on Medium on Dec 17, 2020.

With year-end 2020 fast approaching, we asked our friends over at TokenTax to write this FAQ to answer some of the most common questions we get about donating crypto to a Donor-Advised Fund.

Note: Endaoment does not give tax advice. Please consult a tax professional when determining how a gift of crypto could affect your taxes.

How much can I give?

You may wish to offset your crypto capital gains by giving to a DAF or directly to your favorite charities. The IRS has not yet provided guidance on the charitable giving maximum percentage of Adjusted Gross Income (AGI) for crypto donations, so it is a grey area.

For non-cash donations (i.e., Goodwill), it is 50% of AGI. However, for other items such as stocks it is 20% or 30% of AGI. In previous years, cash was up to 60% of AGI. For 2020, the Cares Act allows taxpayers that itemize to deduct up to 100% of their AGI in cash donations. However, converting to fiat may not be the best tax option because you incur capital gains in the liquidation process.

For more information on IRS rules for crypto charitable donations and gifts, they have published Frequently Asked Questions on Virtual Currency Transactions and and Frequently Asked Questions on Gift Taxes. For more specific guidance, you can always chat with TokenTax about your unique crypto tax considerations.

What’s the difference between giving Long/Short term holdings?

When you are considering the tax implications of donations, you should think about the different tax rates between long term and short term crypto capital gains. Holding assets for greater than one year is considered long term, and less than one year is considered short term by the IRS. While the short term tax rates match your income tax rates, the long term tax rates are as follows for the 2020 tax year:

What’s a DAF?

A Donor-Advised Fund is a special financial account owned and managed by a public charity (that’s Endaoment). DAFs have a Primary Advisor (that’s you), who gives assets to their fund as tax-deductible donations and makes grant recommendations over time to nonprofit organizations. When you donate tokens to an Endaoment DAF, they immediately sell your gift for USDC via Uniswap and deposit the proceeds at your DAF’s address on-chain.

Once funded, you can direct the dollars in your DAF to specific charities by making grant recommendations to more than 1.5 million nonprofit organizations in the U.S. When your grant is reviewed and approved by Endaoment, they’ll contact the receiving organization, onboard them into the Ethereum ecosystem and transfer them the recommended grant amount in USDC.

Donor-Advised Fund (DAF) Tax Implications

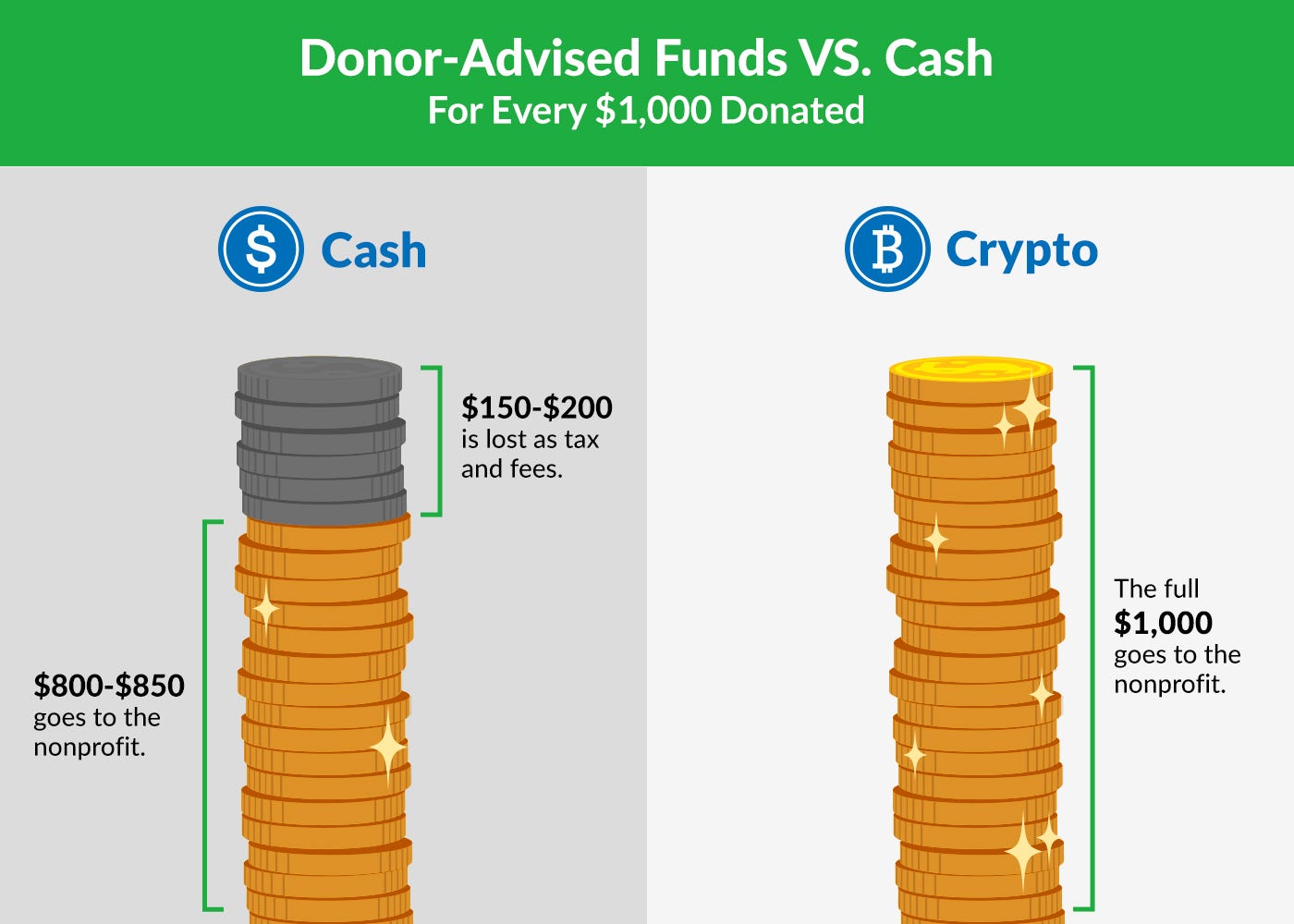

If you are a crypto enthusiast and considering giving to your favorite charities, it is more economical to gift in crypto than to sell your crypto for fiat before donating. Fortunately, the IRS has given clear guidelines on the tax implications of crypto gifts.

*Based on 2020 capital gains tax rates and not including fees

As a donor, you can deposit your long term crypto capital gains, reducing your tax liability. IRS Virtual Currency Questions 33 and 34 detail that there are no capital gains taxes on crypto donations, and the full amount is tax deductible (up to the AGI percentage limit).

You maximize your contribution to philanthropic causes by donating crypto assets directly, instead of donating after you sell them for dollars and incur taxes on the sale. For example, if you have held your crypto for over a year and want to make a USD 1,000 equivalent donation, more of your donation goes to charity if you donate in crypto directly.*

Option A: If you donate in crypto directly, your full USD equivalent of 1,000 (net fees) will be donated. Note that this holds true up to the adjusted gross income (AGI) limits, so please reach out to us about your individual situation if you are planning on donating a very large portion of your AGI.

Option B: Depending on your 2020 tax bracket, your donation will be less as follows:

- If you are in the 15% long term capital gains tax bracket, your USD after-tax donation will be $850 (net fees) for your equivalent of USD 1,000 worth of crypto.

- If you are in the 20% *long term capital gains *tax bracket, your USD after-tax donation will be $800 (net fees) for your equivalent of USD 1,000 worth of crypto.

Tax implications for your crypto trades and sales

As highlighted in the previous donor fund tax example, you are subject to crypto taxes for every trade of crypto for crypto and every sale of crypto for fiat currency. However, simply moving your crypto between wallets and exchanges is not taxed.

In the above example, you are subject to taxes and reporting when you trade your crypto for another crypto on Coinbase or Uniswap. You are also subject to taxes and reporting when you sell your crypto for dollars before donating.

If you’re giving to a DAF (through Endaoment or others), you’re donating your property directly to the Public Charity in question. This would be reported as a donation on your tax return, subject to the rates and restrictions laid out above.